Maybe you saw an advertisement promising the lowest mortgage rates, and just wanted to see if you qualified. But after submitting your application, lenders of every flavor are bombarding you with questions you’re not sure how to answer… what is DTI, ARM, PMI, LTV? Yikes!

Your financing options can be baffling, and these mortgage anagrams and financial questions can feel like an onslaught, but it doesn’t have to be that way.

If you’d like a little clarity, these four tips for straightforward mortgage financing will get you started:

1. Don’t be afraid to ‘play the field’.

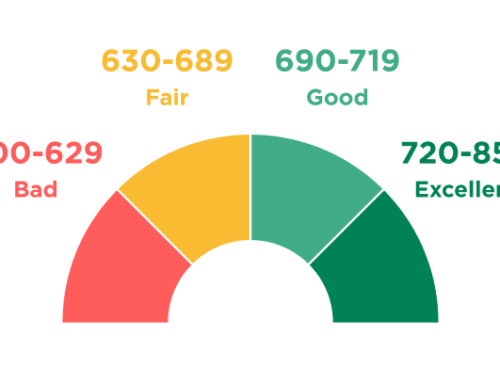

It’s okay to compare rates and terms by applying for different loans with multiple lenders. It’s wise to shop around, and online applications make it easy. The important thing to remember is to submit all your applications within 7 to 10 days to make sure that you don’t incur multiple credit inquiries. Multiple credit inquiries aren’t detrimental and will fall off your credit report within a few months, but having dings in your credit while shopping for a mortgage isn’t optimal.

2. Look for manual underwriting.

Automated approval systems are popular with most mortgage lenders, since it helps them process transactions more quickly. But if your circumstances cause you to land outside of their conventional mortgage qualification requirements, the automated system may reject your application despite your actual worthiness and ability. For that reason, you should make sure that the lender you’re working with is willing and able to manually underwrite mortgages if needed. Manual underwriting allows the lender to see your whole financial picture to make a better informed decision regarding your qualifications and approval.

3. Keep an open mind and consider all your options.

Having a tough time finding the home you want at a price you can afford? Consider expanding your home search to include fixer-uppers, which means you’ll get more home for your money. Mortgage lending institutions including FHA and Fannie Mae offer home loan solutions that combine the home purchase with the home repair costs!

4. Ignore mortgage myths and hearsay.

Many people will tell you that it’s impossible to buy a home without a 20% downpayment, but that’s simply not true. Financing options are plentiful; there are low down payment options, 0% down payment options, and even buyer assistance programs that exist specifically to help buyers with their down payment and closing costs.

We know mortgages and the financing process can be overwhelming, but it’s easier than you think when you have a trusted and experienced lender by your side!