When beginning the homebuying process, it’s normal to ask a ton of questions, especially if it’s your first time buying a home! Asking your mortgage lender questions will reduce the stress of buying a home, and also has the potential to save you thousands!

In an effort to help make sure you’re asking the right questions, here’s a list of the top 9 mortgage-related questions that our experts think you should be asking your lender before you even start shopping for a house:

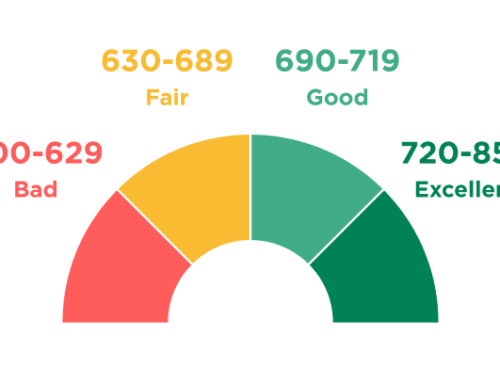

1. What’s the minimum credit score needed to qualify for a mortgage?

The idea that there’s a magic number that your credit must reach to qualify for a mortgage is a complete myth. While your credit score is important, and qualifying for a mortgage will be easier with a good credit score, there are plenty of people with bad credit who are still able to buy a home.

You see, what is and isn’t acceptable in terms of applicant credit scores is different for every lender, and something that’s typically far more important than your score is your actual credit history. The purpose of credit is so lenders can judge how likely you are to pay them back, but your credit score is really only painting part of the picture. When looking at your credit history, the lender can actually see your track record for previous loans, and while some lenders don’t disqualify applicants for things like late payments, most of them will be looking for signs that you’re a financially responsible person.

If your credit score and/or credit history is a concern, talk to your lender and see what your options are. Every situation is different, but a good lender can review your situation and give you the best advice. In many cases, waiting a few months longer while engaging in a few credit-enhancing strategies can save you thousands, as those with good credit scores and histories may qualify for lower interest rates or special offers.

2. Do you offer discount points or mortgage points?

One of the best money-saving mortgage tips is to ask your mortgage lender if they offer mortgage points (also known as discount points). A mortgage point typically costs 1% of your full loan, and can sometimes be purchased at closing to reduce the interest rate on your mortgage. This means you could bring additional cash to closing in exchange for a lower interest rate, which is a smart financial move if you’d like to save quite a lot of money over the life of your mortgage.

Mortgage points aren’t always beneficial to your situation, however. You should as your lender’s opinion on them, relevant to your specific circumstances. Be sure to find out the interest rate reduction given for each point, and also ask about the maximum that can be bought.

3. How do I know what home price I can afford?

Your budget is one of the first and most important things you need to consider before you begin hope shopping. Not only can it help you save time by narrowing your home search, but it can also help you manage your expectations of homeownership. If you spend months looking at homes that are priced around $350,000 and then find out you can only afford a mortgage for less than $300,000 then you might have to remove an item or two off of your home search wish list.

While it’s fairly straightforward to estimate how much house you can afford, the good news is that it’s even easier to simply let a reputable mortgage lender do it for you. Your mortgage lender probably has a pre-qualification or pre-approval questionnaire that you can complete quickly and easily (ours is right online!), and then they can use the information you’ve given to provide tons of invaluable guidance. After reviewing (and perhaps verifying) factors in your financial background such as your credit history, credit score, income, income history, assets, debts, and more, your lender can tell you how much you can afford and how much you’re likely to qualify for.

Perhaps the best part about this process is that your lender can also use your financial background to recommend mortgage types, including special programs that can save you thousands depending on your situation. They can also give you more specific details like monthly mortgage payments, interest rates, down payment amount, closing costs, property taxes, and the other costs and fees that will need to figure into your budget as a homeowner.

4. Should I get an escrow account?

Escrow accounts are a specific type of account that contains the money needed for things like insurance premiums and property taxes. Some loans will require you to have an escrow account, while they are optional for other types of loans. Some lenders require escrow accounts as well, even if your loan does not.

If your lender says you need an escrow account, be sure to ask them how much money needs to be held in the account, and find out what happens in the event of account shortages and account overages.

5. Should I use a mortgage rate lock?

Market interest rates are in constant flux, and this up and down movement can sometimes create a financial question mark in your homebuying plans. A mortgage rate lock is offered by many lenders, and essentially gives you a “promised” interest rate despite market conditions. This means that you can rest easy if rates start to climb while you’re weeks away from closing, because your rate is already locked in.

The downside of mortgage rate locks is that you won’t get to take advantage of falling interest rates, either. Also, if your closing has unforeseen delays, your mortgage lock could expire, putting your interest rate back at the mercy of the market. To make the best decision for you, talk to your lender about the status and likely future direction of current market rates. Also be sure that you know and understand how long the market rate lock is valid for, in the event that your timetable gets off track.

6. Do you offer both conventional loans AND government-backed loans?

Ask your lender what types of loans they are legally qualified to offer, to be sure you’re able to choose the best option for you from all the available mortgage types. Your lender will be able to fully define and explain the differences between the two loan types, but here’s a very brief crash course.

Conventional loans are available to anyone, but each individual lender sets their own requirements and standards. Government-backed loans are available only to people who meet certain standards, but they have smaller down payment requirements and more relaxed credit requirements because they are less risk for the lender.

7. What is the minimum income required to buy a house?

While your income is definitely a major part in determining how much you can afford, there’s not really any minimum income requirements. Mortgage lenders will review and verify any and all sources of income when they begin your qualification process, including uncommon income sources like legal settlements, child support, sales commissions, and so on. Some lenders may choose not to include certain types of income, so be sure to ask your lender what income streams they use to determine your purchasing power.

8. Do I need a 20% cash down payment?

This is yet another homebuying myth. While a down payment of 20% can save you money by allowing you to avoid paying private mortgage insurance (PMI), that doesn’t mean a 20% down payment is required to obtain a mortgage.

Every lender is different, and there are many different loan types, all with differing down payment requirements and stipulations, but in many cases you can buy a home with less than 5% down. Some government-backed mortgages allow 0% down! Talk to your lender about down payment requirements and what concerns or preferences you have regarding the down payment, and they can use that information to help you obtain the perfect mortgage for you.

9. How much will closing costs be?

The term “closing costs” generally encompasses several fees that you have to pay to facilitate the closing, and it is usually paid out-of-pocket at closing. Your closing costs aren’t the same as your mortgage down payment; that is additional and separate.

Closing costs typically include loan origination fees, appraisal fees, title insurance fees, processing fees, and attorney fees, but there could be fewer or additional fees depending on your state and other circumstances of the purchase. Some of the individual fees can also differ depending on your state, the size of your property, your down payment, and even what type of loan you’re receiving.

It’s safe to estimate that your closing costs will be between 3% and 6% of your loan value, but your lender can give you more accurate estimates, and can also explain your options for paying your closing costs. Be sure to ask your lender about all of the fees that make up your closing costs, because while some are legally required, some fees and services are optional and you could choose to have them removed so you don’t have to pay for them.

That’s it!

Posing these questions (and any others you can think of) to your mortgage lender ahead of time will definitely help your home purchase process be a smoother transaction, but more importantly, many of these questions could save you tens of thousands of dollars!

If you’re interested in working with a reputable and experienced mortgage lender like Galaxy Mortgage, click here to apply now!