It’s a common misconception that you’re required to have a 20% down payment to purchase a home, but did you know that some mortgages will allow your home purchase to occur without ANY down payment at all?

If you’re interested in buying a home with a low or NO down payment, we’re here to review some of your mortgage options!

What is a down payment?

The down payment is typically calculated as a percentage of the total mortgage amount, and it’s required to be paid at closing. Mortgage lenders prefer to have a required down payment, because it acts as proof to them that you are capable of saving and managing money, thereby reducing the risk that you won’t pay them back for the loan.

However, it’s sometimes tough even for financially responsible home buyers to save up a cash lump sum for the down payment, so the government created a few zero-down government-backed mortgage programs. Government-backed means they will pay the lender back in the event that you stop paying on the loan, which essentially eliminates the risk to the lender, allowing the lender to approve mortgages for people who don’t meet their typical requirements, such as borrowers who do not have a down payment.

However, just because the lender’s risks are reduced doesn’t mean these government-backed zero-down mortgages don’t have requirements that must be met!

USDA Mortgage Loans

A USDA loan is a home mortgage that is backed by the United States government for the purpose of encouraging growth and development in more rural areas. The United States Department of Agriculture offers USDA loans with $0 down and lower fees than most other loan types, extending itself financially, as a way to incentivize people to purchase homes in specific areas that are typically more suburban or rural.

That means that the home you are purchasing must meet certain criteria, in addition to the criteria that you yourself must meet, in order to meet the qualifications for a USDA loan. The USDA has a map of eligible areas, but in addition to the home being located in a zone of eligibility, it also must be a single-family residence, must be lived in as your primary residence, and can not be a working farm, among other residential requirements and stipulations.

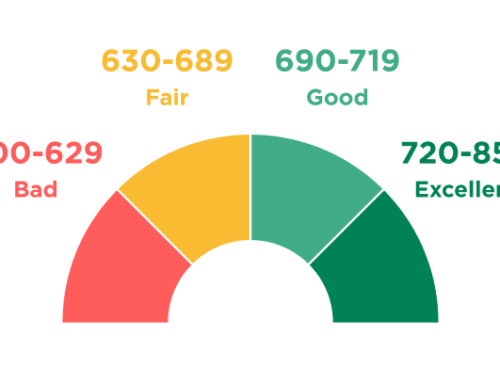

Some of the financial requirements for the borrower include a debt-t0-income ratio lower than 45% and a minimum FICO® credit score of 640. Additionally, your household income must be less than 115% of the median income for the rest of the county; this means that if your household income is significantly higher than those in the county you’re purchasing a home in, you aren’t eligible for a USDA loan.

VA Mortgage Loans

VA loans are another type of government-backed mortgage, but this loan is specifically for active-duty members of the United States Military, U.S. Military veterans, spouses of deceased U.S. Military veterans, and members of the U.S. National Guard. As you may have already guessed, VA loans are provided by the Department of Veterans Affairs for the purpose of honoring service members and their families by making home purchases more affordable by offering 0% down and other financial benefits as well.

The requirements to qualify for a VA loan include a minimum credit score of 640, but there are also stipulations for qualifying military service as well. VA loans require the borrower to meet at least one of the following qualifications:

- 90 consecutive days of active service during wartime

- 181 consecutive days of active service during peacetime

- 6 years or more of service in the U.S. National Guard or Reserves

- Spouse of a U.S. service member who died from a service-related injury or disability, or died directly in the line of duty

Other Zero Down Mortgages

In addition to VA and USDA loans, there are other mortgage programs and lenders out there that offer the option of zero down payment for borrowers in certain circumstances.

Many lending institutions across the country offer zero-down mortgage programs to borrowers with exceptional credit scores, specific financial situations, or certain career fields. For example, there is a mortgage program specifically for newly minted medial doctors and dentists, as well as for medical residents and fellows, to help these new professionals establish their footing despite overwhelming student debt.

An experienced and knowledgable mortgage professional can help you discover zero-down mortgage programs that you may qualify for, depending on your individual traits.

Low Down Payment Mortgages

In the event that you can’t quite qualify for any of the zero-down mortgages, don’t despair; there are even more options for mortgages that have low down payment requirements.

Many people will tell you that you can’t get a conventional mortgage without putting 20% down, but that is a myth. Every lender is different, but most lenders will permit a conventional mortgage with as little as 3% down. The myth about a 20% down payment stems from the requirement for PMI (private mortgage insurance). PMI is an additional monthly fee that gets added to your mortgage payment, it’s required by the lender if you have less than 20% equity in your home, and paying it offers you no benefits at all.

For that reason, canceling PMI on your mortgage is something most homeowners aim to do as early as possible, and the only way to avoid paying PMI altogether is to have a 20% down payment, to ensure that you begin your mortgage with at least 20% equity in your new home. Of course this is a wise financial decision and saves you thousands (or tens of thousands) of dollars over the term of your mortgage, but being unable to come up with 20% of your home’s purchase price will definitely NOT keep you from buying a home!

If you’re about to come up with even 3% to 5% for a down payment, you’re likely to qualify for hundreds (or thousands) of different conventional mortgages, and you may even qualify for a government-backed FHA loan. FHA loans can be had with a 3.5% down payment, and are backed by the U.S. Federal Housing Administration as a way of assisting first-time homebuyers and/or homebuyers with moderate to low income levels. Although FHA loans have fewer stipulations than USDA and VA loans, there are still some restrictions and qualifications to meet, including the property you’re purchasing must be your primary residence, and you must be able to move into the property within 60 days after closing. Furthermore, the home itself must meet certain standards of livability, including HUD’s (Housing and Urban Development) minimum residential health and safety standards. It only makes sense that the Federal Housing Administration wouldn’t want to help anyone purchase a home that will be a hazard to their health or safety!

One example of a conventional mortgage option requiring only a 3% down payment is a Home Possible®loan. In addition to the 3% down payment, it also offers reduced mortgage insurance options to save you even more money. To qualify, you must have an income that is less than the median income in the immediate area of the property, however, this stipulation only applies to the person or persons obtaining the mortgage instead of the full household income.

In closing…

…it’s not impossible to get a mortgage with no down payment, but it’s more probable that you’ll qualify for any of the thousands of low down payment mortgages. Whether you’re looking for a government-backed mortgage or a conventional mortgage, there are options out there that meet your needs. Apply now to see which ones you qualify for, and take your first step towards buying a home!